For the phases of your financial life

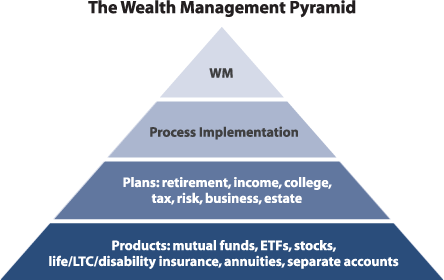

Wealth management refers to the coordination of various strategies that encompass all phases of your financial life, from the accumulation of assets, to risk management, to tax strategies, to retirement and estate planning. The easiest way to conceptualize wealth management is to think of it as the logical transitions of your financial life:

Accumulation of Wealth

Construct a solid, financial base sufficient to pursue your financial objectives.

Protection of Wealth

Create a strategy aimed at preserving your assets from erosion due to unexpected expenses, inflation, market decline, and taxes.

Tax-Advantaged Distribution of Wealth During Life

Develop a sophisticated tax management plan to minimize your tax burden and allow you to distribute assets according to your wishes.

Tax-Advantaged Distribution of Wealth at Death

Plan for the controlled distribution of assets at death—to whom you want, when you want, and at the lowest possible cost.